Travel insurance: the one thing you buy hoping never to use.

When I started looking into AXA Travel Insurance, I wondered, “Is this a safety net or a marketing gimmick in a fancy suit?”

With its global reputation and promises of comprehensive coverage, AXA seems like a no-brainer. But as any seasoned traveller knows, the devil is in the details. And trust me, there are plenty of details.

Let’s see if AXA is really the dependable co-pilot it claims to be, or if you’re better off strapping in with a more adventure-ready option like Rise & Shield.

Buckle up. This AXA Travel Insurance review could get bumpy.

Ready? Let’s roll.

What Is AXA Travel Insurance?

Let’s be real. Travel insurance isn’t the most exciting part of trip planning, but it can be a total lifesaver when things go south.

AXA is a well-known name in the travel insurance world, offering a range of policies to cover everything from a quick weekend escape to an epic, months-long adventure across the globe.

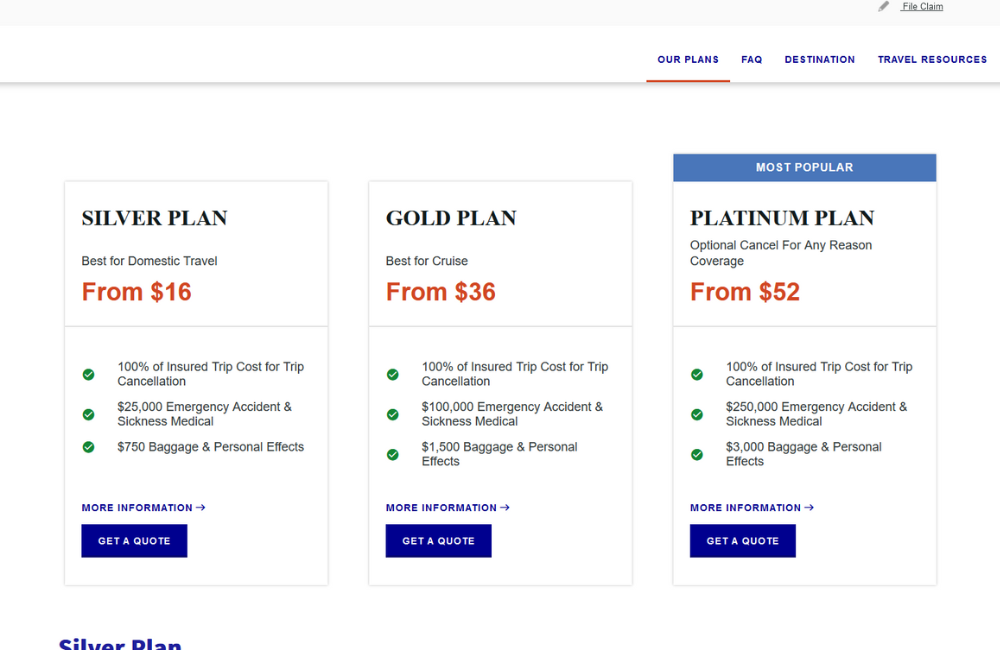

With AXA, you can choose from several plans based on your budget, destination, and how much risk you’re comfortable with.

Whether you’re worried about losing your luggage or facing a hefty hospital bill abroad, AXA promises to have your back with coverage options that fit most travel scenarios.

But here’s the thing: big names don’t always mean big reliability.

While AXA’s global presence gives them serious street cred, does that translate into real-world reliability when you need to file a claim or get emergency help?

Spoiler alert: It’s a mixed bag. Some travellers swear by AXA, while others have faced frustrating delays and red tape when making claims.

So, is AXA the travel insurance superhero it claims to be?

Let’s take a closer look at its pros and cons.

Ready for unlimited adventure? Get travel insurance that covers over 150 activities and 190 destinations.

Pros and Cons of AXA Travel Insurance

Like any travel insurance provider, AXA has its highs and lows. Let me break down the key pros and cons so you know exactly what you’re signing up for.

Pros:

- Wide Range of Coverage Options: AXA offers several plan tiers, ensuring travellers can choose the right coverage based on their budget and destination.

- Medical Emergency Coverage: Comprehensive medical coverage, including COVID-19 protection on some plans.

- Travel Assistance Services: Access to a 24/7 helpline for emergency support and travel advice.

Cons:

- Claim Processing Complaints: Some customers report slow claim processing times and bureaucratic red tape.

- Coverage Gaps in Basic Plans: Entry-level policies can lack essential coverage and require upgrades.

- Complex Policy Details: AXA’s policy documents can be difficult to interpret due to industry jargon.

Still interested in this AXA Travel Insurance review? Great.

Next up: what’s included in AXA’s travel insurance coverage?

What's Included in AXA Travel Insurance Policies?

When I’m planning a big trip, the last thing I want is to think about what could go wrong. But, let’s be honest, travel can be unpredictable.

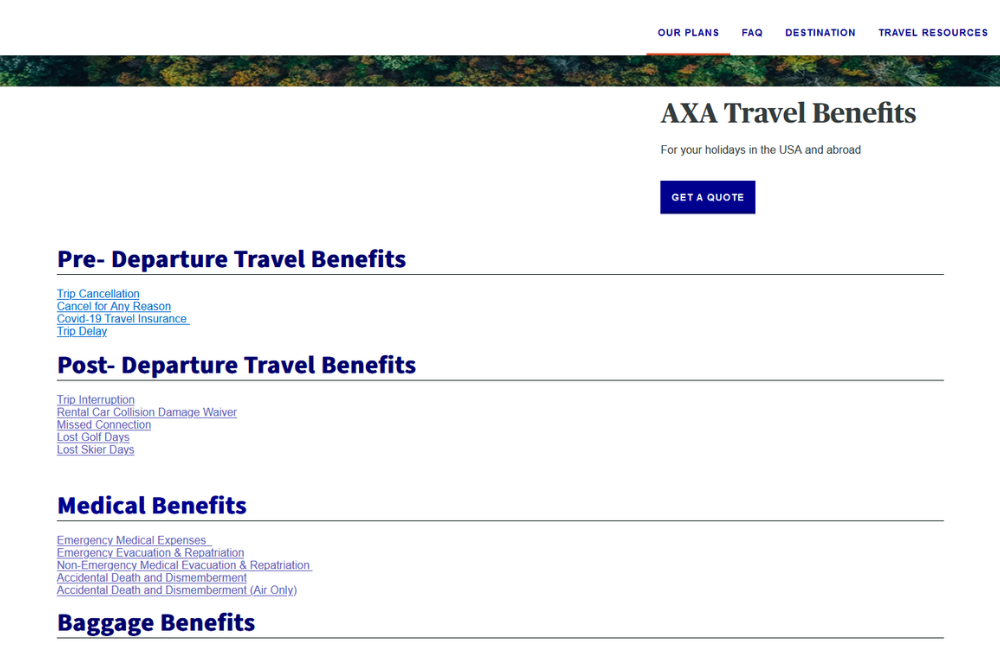

AXA offers a range of coverage options designed to handle common travel disasters, though you’ll want to dig into the fine print before counting on them.

Here’s a closer look at what’s included in most AXA travel insurance plans, and why these features matter when you’re on the move:

Medical Expenses

Getting sick or injured abroad is a nightmare scenario. AXA covers emergency medical and dental expenses, which can save you from sky-high hospital bills.

But keep in mind, "emergency" is the key word here—you’re not covered for routine checkups or pre-existing conditions unless you’ve paid for an upgrade.Ready for unlimited adventure? Get travel insurance that covers over 150 activities and 190 destinations.

Trip Cancellations or Delays

AXA promises reimbursement if your trip gets cancelled or delayed for a covered reason—think natural disasters, sudden illness, or airline strikes.

Just be ready to prove everything with documentation (and lots of patience).

Non-refundable flights and hotel bookings can add up fast. If you’re planning a dream trip, this coverage can help you avoid losing thousands if the unexpected happens—just don’t expect it to cover "I changed my mind" cancellations.

If that sounds like you, rather opt for a Travel Insured International policy as they have “Cancel for Any Reason” cover.

Lost or Delayed Luggage

We’ve all had that sinking feeling watching the baggage carousel spin with no sign of our luggage.

AXA covers lost or delayed bags, though the amount they’ll reimburse depends on your plan.

My Pro Tip: Take photos of your bags and keep receipts for expensive gear.

Whether it’s your hiking boots or laptop, replacing essential items while travelling can get ridiculously expensive. AXA helps take the sting out of lost luggage, but be prepared to wait a while for that payout.

Personal Liability

This one’s often overlooked but super important. If you accidentally damage someone’s property or cause an injury while abroad, AXA’s personal liability coverage steps in (up to a certain limit, of course).

Imagine renting a car and scratching it—or worse, causing an accident. Without liability coverage, you’d be on the hook for repair costs or medical bills that could ruin more than just your trip.

Adventure Sports Add-ons

Love thrill-seeking? AXA offers add-ons for activities like skiing, scuba diving, and even bungee jumping.

Just know that "extreme sports" coverage can be surprisingly limited, and not every activity you consider adventurous will make the cut.

If you’re chasing adrenaline on your travels, basic AXA insurance won’t cut it.

Double-check that AXA’s adventure sports coverage actually includes your planned activities, or you could end up footing a hefty medical bill if something goes wrong.

My opinion? Rise & Shield offers coverage for over 151 adventure activities. Definitely worth a look if you want an AXA travel insurance alternative.

Let’s continue my AXA Travel Insurance review. I did some digging to find out what’s not covered by AXA.

What's Not Covered by AXA Travel Insurance

Travel insurance isn’t a magic shield that covers everything. AXA’s policies come with a list of exclusions that could leave you footing the bill if you’re not careful. Here’s what you need to watch out for:

Pre-existing Medical Conditions

Unless you’ve declared and paid extra for specific coverage, AXA won’t cover pre-existing medical conditions.

Even then, approval can be tricky depending on the condition’s severity and stability before your trip.

If you have a chronic illness (looking at my diabetes) or past health issues, you could be stuck paying out of pocket if something flares up while travelling.

High-Risk Activities

Think skydiving, high-altitude trekking, or even scuba diving beyond a certain depth—AXA considers many thrill-seeking activities “high-risk.”

Some can be covered with adventure sports add-ons, but read the fine print. It’s not as comprehensive as it sounds.

You don’t want to find out after you’ve broken a leg base-jumping that your adventure wasn’t covered.

If adrenaline sports are part of your travel plans, make sure your policy has your back, or consider a more adventure-friendly insurer like Rise & Shield.

Travelling Against Government Advice

Heading to a country flagged by your government’s travel advisory? You’re on your own.

AXA won’t cover trips to the most dangerous places to travel, no matter how adventurous (or necessary) your visit might be.

But there’s more.

Political instability, natural disasters, or disease outbreaks can prompt sudden travel bans. If your dream trip is in a higher-risk location, consider a more flexible insurance option. Or better yet, reschedule for safer times.

Ready for unlimited adventure? Get travel insurance that covers over 150 activities and 190 destinations.

Intentional Negligence

Accidents happen, but AXA draws the line at incidents caused by reckless behaviour. That includes anything from over-the-top partying (looking at you, tequila shots) to ignoring posted safety signs or engaging in risky behaviour.

If you’re caught acting irresponsibly—especially under the influence—you can kiss your coverage goodbye.

Okay, now we’ve looked at what’s not covered by the standard AXA travel policy. Next in this review, let me teach you how to get and use AXA Travel Insurance cover.

Using an AXA Travel Insurance Policy

If you go with AXA, here’s how to get started, customise your coverage, and stay ready for any travel curveballs.

Step 1: Get an AXA Travel Insurance Quote

The first step is getting a travel insurance quote through AXA’s website.

Be ready to enter your trip details, including travel dates, destinations, and the number of people you’re covering. The system will generate several policy options based on what you enter.

My Pro Tip: Be specific about your activities. If you’re planning something adventurous like backpacking or snowboarding, don’t assume it’s covered. Make sure to check the “adventure sports” add-on if needed.

Ready for unlimited adventure? Get travel insurance that covers over 150 activities and 190 destinations.

Step 2: Customise Your AXA Travel Coverage

Once you’ve got your quote, take time to customise your policy. AXA lets you adjust coverage levels for medical emergencies, trip cancellations, and luggage protection. You can also add extras like rental car insurance or winter sports coverage.

Step 3: Manage Your AXA Travel Policy

After purchasing, keep your insurance details handy. Print out your policy documents or save them as PDFs on your phone (I recommend both).

AXA also has an app where you can manage your policy, check coverage details, and file claims.

My Pro Tip: Save important numbers. Add AXA’s 24/7 helpline and claims service to your phone’s contact list before you leave. In an emergency, you won’t want to waste time digging through old emails.

Using AXA’s travel insurance isn’t rocket science, but knowing the process before you need it can save valuable time when you’re abroad.

Of course, if you want insurance that’s easier to manage and more adventure-friendly, you might want to check out Rise & Shield instead.

And that begs the question, what do we do if we need to file a claim with AXA? Here’s what I learned.

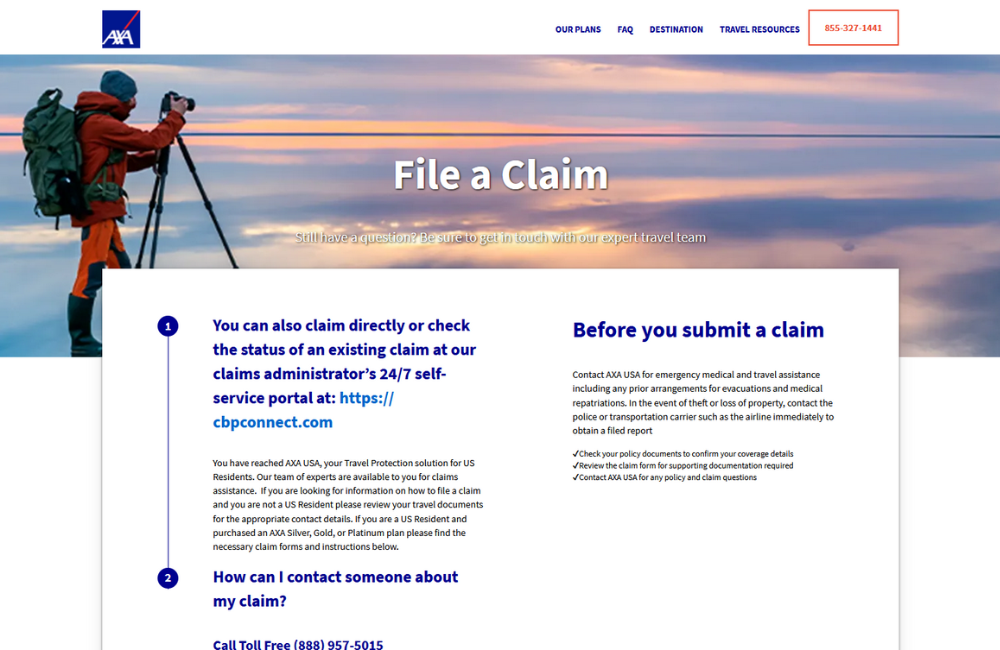

Filing a Claim with AXA Travel Insurance

AXA has an online claims portal, which sounds convenient. But, based on customer reviews, patience and persistence might be your best travel companions.

Here’s how to file a claim with AXA Travel Insurance:

Step 1: Gather Your Documents

Before you even think about submitting a claim, make sure you’ve collected all the necessary paperwork. This includes:

- Receipts for expenses like hotel bookings, medical treatments, or replacement items for lost luggage.

- Police Reports for theft or lost property (file one ASAP if something is stolen).

- Medical Certificates from doctors or hospitals detailing treatments received.

My Pro Tip: Take photos of everything. Snap pictures of receipts, boarding passes, or even damaged items. Having digital backups can save you from a claim rejection due to "missing documents."

Step 2: Submit the Claim Online

AXA’s online claims portal is your go-to place for submitting claims. Create an account, fill out the required forms, and upload your supporting documents.

Be as detailed as possible when explaining what happened. It could speed up the process.

Don’t wait until you’re back home if you can help it. Claims filed quickly after the incident are often processed faster.

Step 3: Follow Up (and Be Persistent)

After submitting your claim, don’t assume the job is done.

AXA is known for its slow claims processing—some travellers have waited weeks (or even months) for a resolution. Set reminders to follow up regularly and keep notes of every interaction.

Here’s how I deal with this:

Stay polite but firm. Keep emails professional and clear. If you’re getting nowhere, consider escalating your claim through AXA’s complaints process or involving a travel ombudsman if needed.

All good? Excellent. Let’s continue my AXA Travel Insurance review by looking at what other travellers have to say about this cover.

Other Online Reviews of AXA Travel Insurance

When it comes to AXA Travel Insurance, customer experiences are a mixed bag.

On Trustpilot, AXA holds a 1.2 out of 5-star rating, with 93% of the 1,492+ reviews falling into the "Bad" category.

Common complaints include prolonged claims processing and unresponsive customer service. For instance, one reviewer mentioned waiting over a year for claim resolution, despite multiple follow-ups.

Similarly, the Better Business Bureau (BBB) reflects these concerns.

AXA Assistance is not BBB accredited and has a customer review rating of 1.63 out of 5 stars, based on 19 reviews.

Customers frequently report issues with claim denials and delays.

One customer shared that after a flight delay necessitated booking a new international flight, their claim filed in February 2022 remained unresolved as of November 2022, despite numerous attempts to contact the company.

TL;DR:

While AXA is a well-established name in the insurance industry, the reviews I found highlight potential challenges in their claims process and customer service.

It's crucial to thoroughly read and understand the policy details and consider these experiences when choosing a travel insurance provider.

Ready to wrap up this review? Let’s do it.

My Final Verdict

So, would I recommend AXA Travel Insurance as the best travel insurance for you?

It depends.

If you’re after a well-known insurance provider with solid coverage options and don’t mind navigating some red tape, AXA could work for you.

Their wide range of policies and optional add-ons for adventure sports are definite pluses if you’re willing to read the fine print and stay persistent during claims.

But if you want travel insurance built for adventure seekers, with faster claims processing and fewer coverage loopholes, it might be worth exploring AXA alternatives like Rise & Shield, World Nomads, or even AIG.

For instance, designed with adventurers in mind, Rise & Shield keeps things simple and transparent. The result? You can spend more time exploring and less time untangling insurance jargon.

Ready for unlimited adventure? Get travel insurance that covers over 150 activities and 190 destinations.