Everest Base Camp Insurance

Everest Base Camp insurance built for 6,500-metre treks and heli-evacuations. Quick & easy.

Reach Everest Base Camp (5,364m) with confidence.

Our Everest Base Camp insurance is tailored for high-altitude trekkers challenging EBC. Our trekking insurance is fast, straightforward and designed so you can focus on the views, not the what-ifs.

With our Adventure Extreme Add-on, you’re covered for:

- Trekking and hiking up to 6,500m altitude.

- High-altitude guided expeditions.

- Emergency medical cover (including altitude sickness).

- Helicopter evacuation (with pre-approval).

- Repatriation and 24/7 emergency support.

What's included in our EBC insurance?

You're covered for:

- Worldwide emergency medical expenses: We pick up overseas hospital bills and put our 24/7 assistance team on speed-dial if altitude sickness or a twisted knee takes you out of the game.

- Trip cancellation & curtailment: When sickness, family emergencies or government advisories force you to scrap the trek (or bail out early), we refund the non-recoverable costs so you can re-plan without draining the expedition kitty.

- Evacuation and repatriation: Helicopter lift-outs or overland stretcher hauls are organised and paid for (pre-approval required), and we get you home or to a higher-care facility if a doctor says you can’t continue.

- Baggage & equipment loss or damage: From down jackets to DSLR cameras, we reimburse or replace trekking gear that’s stolen, lost or accidentally trashed in transit.

What's not included in this policy?

Our Everest Base Camp cover does not extend to:

- Altitudes above 6,500m or any trekking higher than the Adventure Extreme limit are out.

- Solo or off-route expeditions that wander away from recognised trails or go unguided.

- Helicopter rescues without prior authorisation (and the separate excess unpaid).

Rise & Shield is trusted by reputable tour operators and adventure companies

What does our Everest Base Camp insurance cover?

With Rise & Shield’s EBC cover, we safeguard every stride up the Khumbu, from the hair-raising Lukla runway to that frosty sunrise on Kala Patthar. We built this policy for high-altitude trekkers.

Medical Emergencies and Evacuation

We settle overseas hospital bills and, when a doctor orders it, organise helicopter lift-outs or overland stretcher hauls.

Equipment Loss or Damage

We cover your trekking poles, down jacket, sleeping bag, DSLR if they’re lost, stolen or accidentally wrecked in transit. Travelling with high-ticket tech? Bolt on our High-Value Items rider for extra gadget peace of mind.

Travel Inconvenience Benefit

Grounded flights, landslide-blocked trails, strike-hit buses—when logistics implode, we refund reasonable extra transport and accommodation costs so the itinerary stays on track.

Plus loads more benefits...

Why do I need Everest Base Camp insurance?

EBC cover isn’t for tourist strolls. It’s for the altitude-bitten trek where storms, strikes and sudden illness can reshape the whole expedition.

We recommend grabbing a policy when:

- Your trail rises above easy-rescue altitude. Remote Khumbu valleys mean heli lifts aren’t cheap; we arrange the evacuation and pay the bill so you can focus on acclimatising.

- Your kit wallet can’t take a hit. Think down jackets, carbon poles, mirrorless camera. If it’s lost in transit or buried in a yak-train mishap, we sort the repair or replacement.

- Permits, flights or teahouse stays are pre-paid. Lukla delays, airline strikes or lodge closures can nuke a carefully chained itinerary; our trip disruption cover refunds those non-refundable costs so Plan B isn’t a budget buster.

- Medical help is days (and ridgelines) away. We front overseas hospital expenses and organise repatriation if AMS, fractures or frost nip end the trek early.

Lock in cover before you lace the boots, not after the mishap. We’ll handle the paperwork; you handle the selfies.

Why choose our Everest Base Camp insurance?

Opting for Rise & Shield means picking cover engineered for Himalayan altitude and Khumbu logistics. Here’s why we stand out:

- 24/7 Altitude-Savvy Support: Our assistance doctors know AMS from HAPE and speak directly with Nepali rescue crews. Help is literally on call, night or day.

- Streamlined, Trek-Specific Claims: Flight delays at Lukla, lost duffels in Kathmandu, our claims team has seen it all and pays out fast, no Everest-sized paperwork.

- Specialist Evacuation Network: We pre-arrange heli partners in the Khumbu on standby, so a lift-out never hinges on frantic last-minute calls.

- Transparent Pricing, No Altitude Surcharge (≤ 6,500 m): You won’t get stung for climbing to Base Camp elevation; the premium is locked in at quote time.

- Customisable Add-Ons: Bolt on High-Value Items cover for mirrorless cameras or satellite comms, or extend the trip dates if your acclimatisation schedule shifts.

With Rise & Shield’s Everest Base Camp insurance, we keep the risk management grounded so you can keep your eyes on the panorama.

How to buy high-altitude trek insurance with Rise & Shield

Getting a free quote with Rise & Shield is easy. Follow these simple steps to secure your trip:

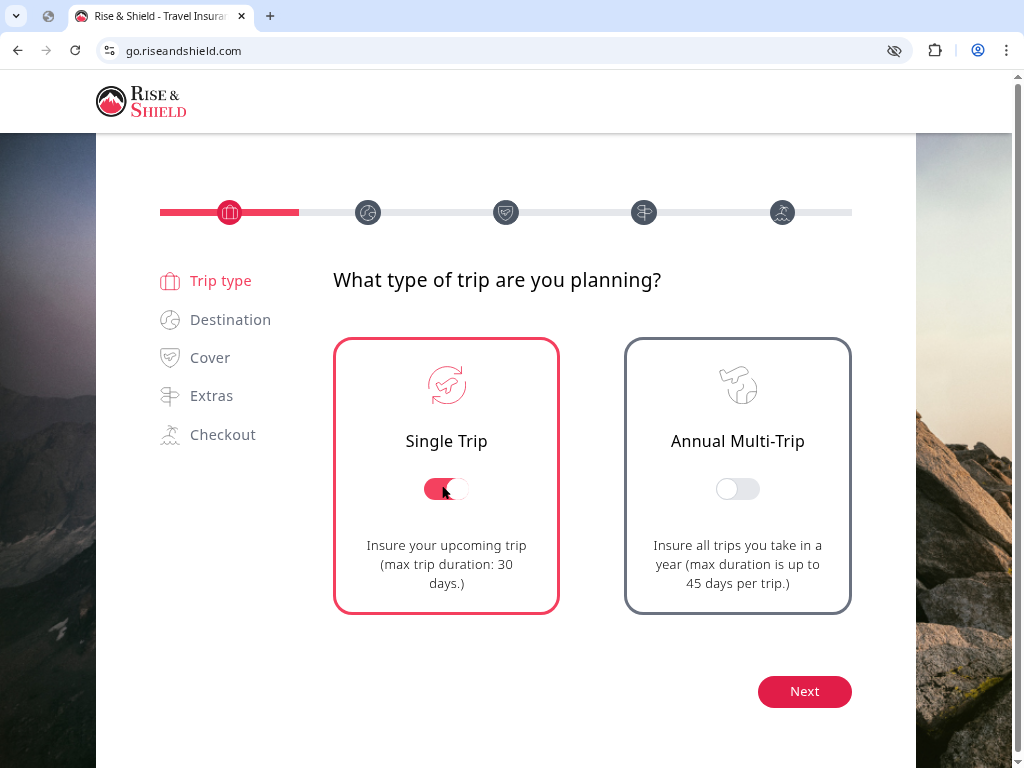

1. Start your quote

- Go to go.riseandshield.com

- On the first screen, under “What type of trip are you planning?”, select: Single Trip (for your specific EBC trek), Then click Next.

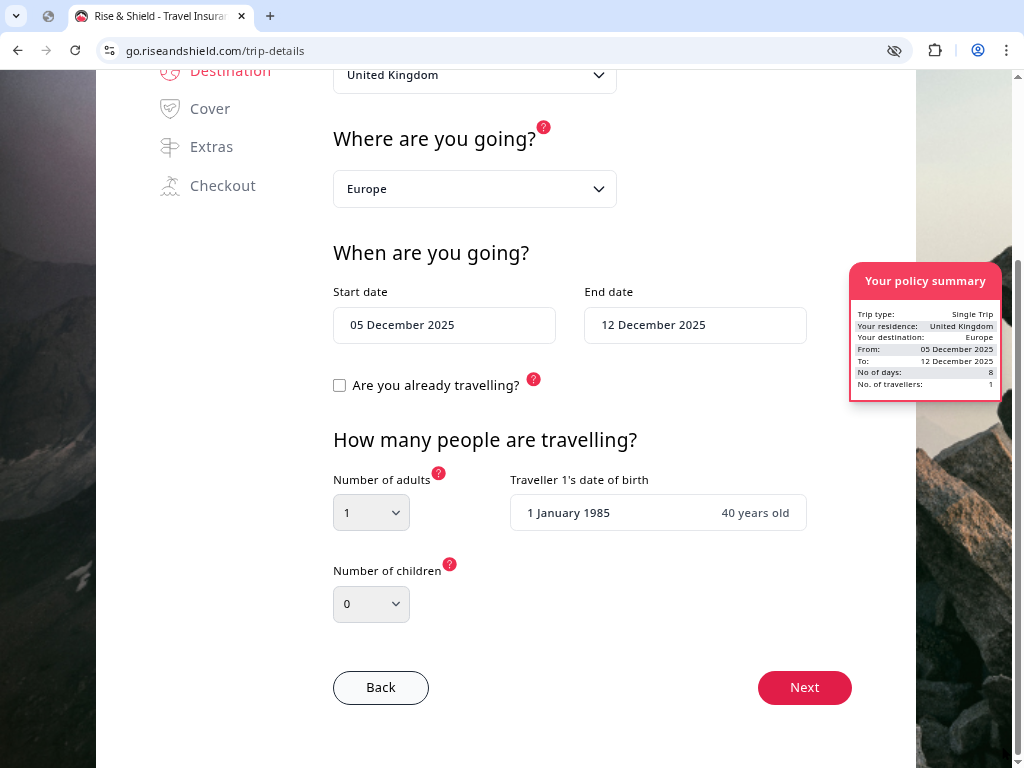

2. Add your trip details

On the Destination step: Country of residency: Choose your usual country of residence from the drop-down (e.g. United Kingdom).

Where are you going?

Choose the region that matches your itinerary, for example:

- Worldwide (excluding North America)

The key is: pick the region that covers every country you’ll set foot in on the way to and from your EBC trek.

When are you going?

Select your start date as the day you leave home, not just the day your trek starts.

Select your end date as the day you arrive back home.

This makes sure flights, hotel nights and delays around the trek are all covered.

How many people are travelling?

- Choose the number of adults and children.

- Enter each traveller’s date of birth when prompted.

Click Next to move on.

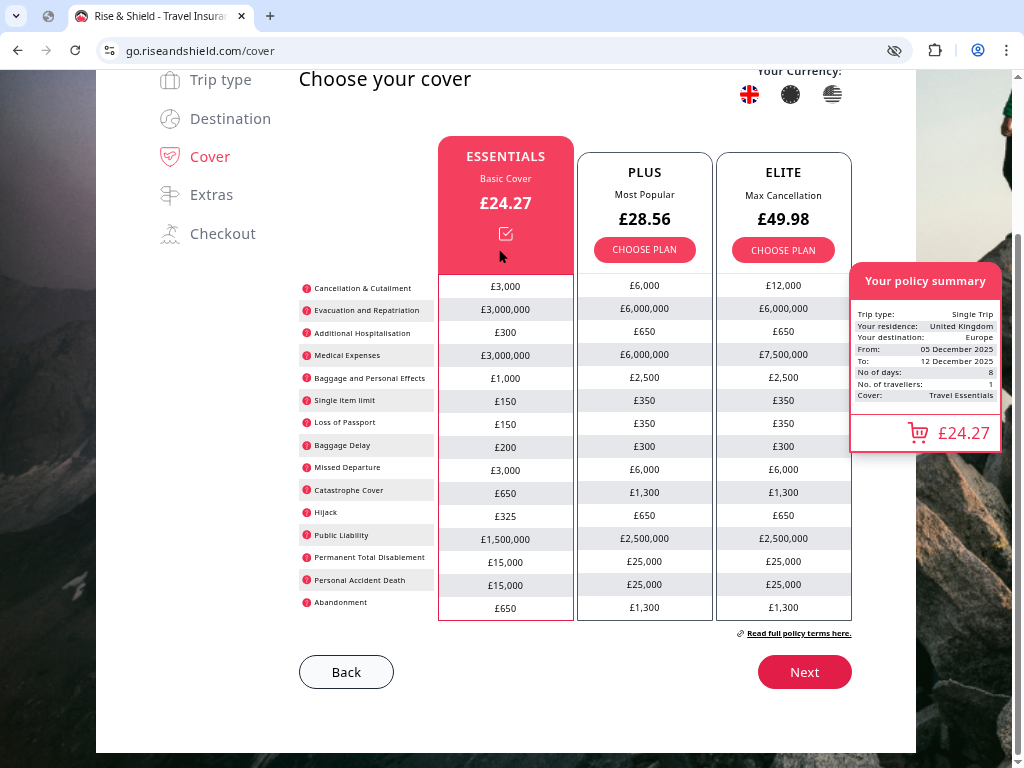

3. Choose your base cover (Essentials / Plus / Elite)

On the Cover step you’ll see three options:

- Essentials

- Plus

- Elite

Your ability to trek EBC at altitude depends on the Adventure Extreme add-on, not which of these three you pick.

However, because high-altitude treks are remote and can be pricey, many trekkers go for Plus or Elite to get higher limits for:

- Emergency medical expenses

- Emergency evacuation and repatriation

- Trip cancellation/curtailment

Click the card for Essentials, Plus or Elite (whichever suits your budget and risk appetite).

Hit Next.

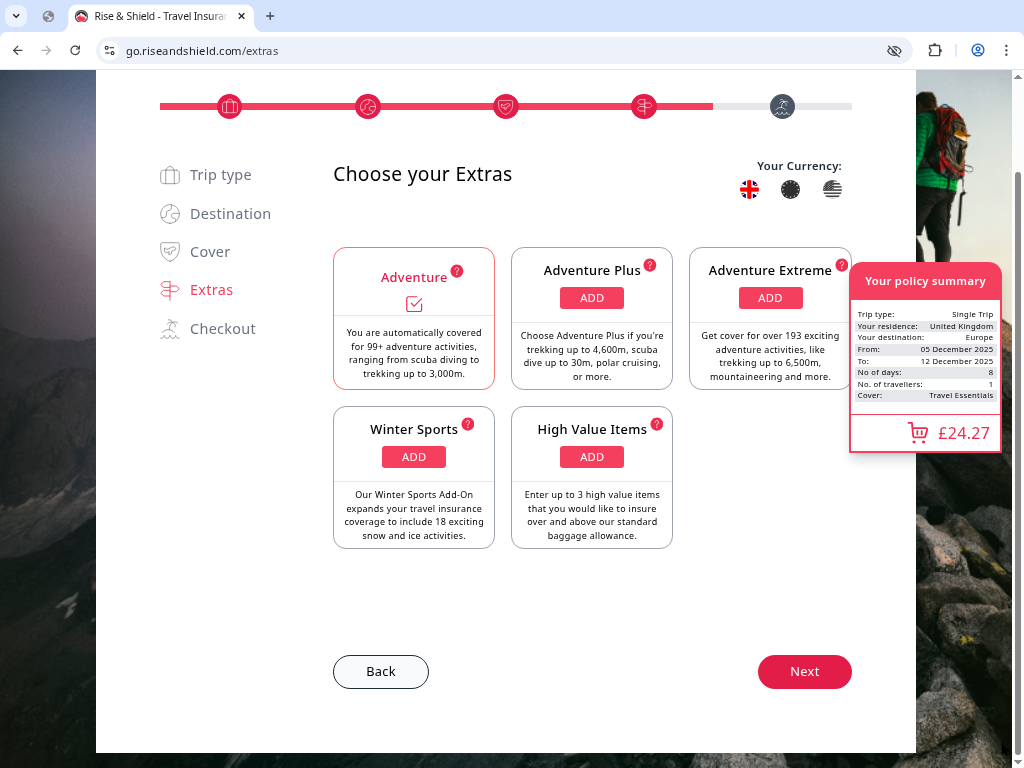

4. Add high-altitude trekking cover (Adventure Extreme add-on)

This is the crucial step for EBC-type trips.

On the Extras page you’ll see several tiles:

- Adventure: automatically included for a wide range of standard activities.

- Adventure Plus: for mid-level adventure (e.g. lower-altitude trekking, certain dives, etc.).

- Adventure Extreme: for high-altitude treks such as Kilimanjaro, Everest Base Camp and similar expeditions.

- Winter Sports, High Value Items, etc.

For high-altitude trekking like Kili or EBC you must:

- Find the Adventure Extreme tile.

- Click ADD on that tile.

- Check the policy summary box on the right:

The price updates.

Adventure Extreme appears under your cover/extras.

Remember: If Adventure Extreme is not listed, your high-altitude trek is not correctly covered, even if you’ve chosen a base policy.

Leave other extras (Winter Sports, High Value Items, etc.) off unless you specifically need them.

Click Next once Adventure Extreme is clearly shown in your summary.

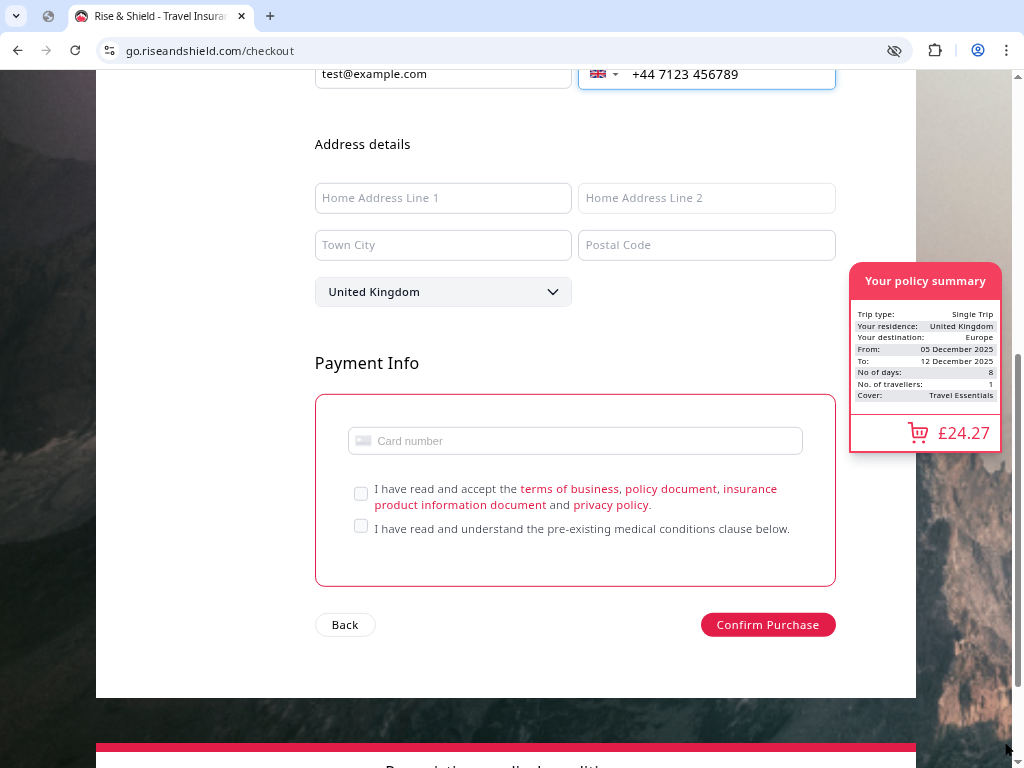

5. Enter traveller, contact and address details

On the Checkout step:

Traveller details

- Enter your first name and surname exactly as they appear on your passport.

- Confirm your date of birth (auto-filled from earlier).

- Select your nationality from the drop-down.

Contact information

- Add an email address – this is where your policy documents are sent.

- Add a mobile number, including the country code if needed.

Address details

- Fill in your home address, town/city, postcode and confirm your country.

6. Payment & final checks

At the bottom of the Checkout page:

- Enter your card details securely.

- Tick the checkboxes to confirm.

- When you’re ready, click Confirm Purchase to complete the policy.

That’s the moment the policy is actually bought, so double-check:

- Dates are correct from leaving home to returning home.

- The destination region matches your full route.

- Adventure Extreme is still listed in your policy summary.

7. After you’ve bought the policy

Check your email for:

- Policy schedule (shows your dates, regions, add-ons like Adventure Extreme, and benefit limits).

- Full policy wording.

And then...

- Save a copy to your phone/tablet and/or print a copy to keep with your travel documents.

- Make a note of the emergency assistance number so you have it handy on the trek.

Everest Base Camp insurance FAQs

Yes. With our Extreme Adventure add-on, we insure trekking up to 6,500m, well above Base Camp’s 5,364m altitude.

No. Any mountaineering that relies on fixed-ropes, ice-axes or crampons above 2,500m is excluded. Summit attempts therefore sit outside this policy.

Solo or off-route expeditions aren’t covered. You must stay on recognised trails and be with a licensed guide.

All heli-evacuations need pre-approval from our 24-hour Emergency Assistance Centre and carry an excess. We organise and pay the rest once authorised.

We reimburse or replace trekking gear under our baggage and personal-effects section—subject to single-item limits and normal wear-and-tear deductions.

Call our 24/7 medical line on +44 (0) 1273 624 661 (or email operations@maydayassistance.com) as soon as possible; inpatient treatment, CT/MRI scans, and any evacuation must be cleared through that team within 48 hours.